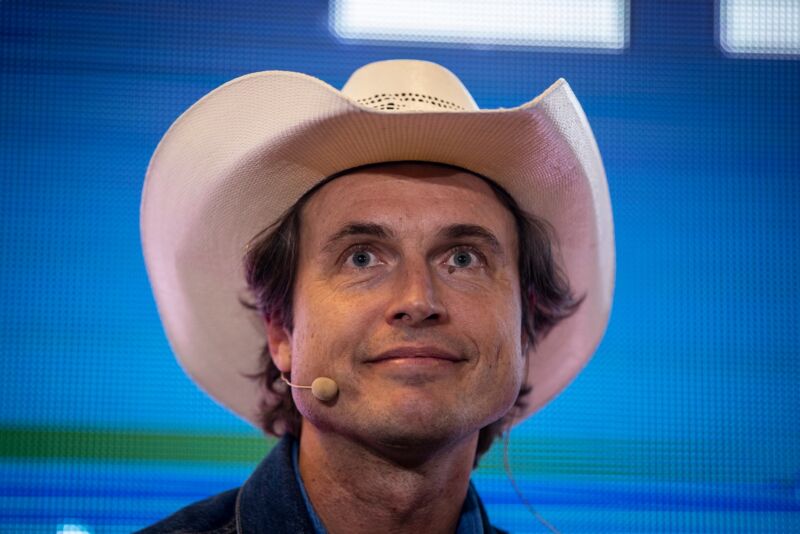

Enlarge / Kimbal Musk at the ETHDenver conference in Denver, Colorado, on Friday, Feb. 18, 2022. (credit: Getty Images | Bloomberg)

The Securities and Exchange Commission is investigating whether Tesla CEO Elon Musk and his brother, Kimbal Musk, violated insider-trading rules with recent stock sales, The Wall Street Journal reported yesterday.

"The SEC's investigation began last year after Kimbal Musk sold shares of Tesla valued at $108 million, one day before the Tesla chief polled Twitter users asking whether he should unload 10 percent of his stake in the electric-car maker and pledging to abide by the vote's results," the Journal wrote.

Separately, a US judge yesterday denied Tesla and Musk's various requests related to their claim that the SEC is "harassing" the company and its CEO. (More on that later in this article.)

Read 15 remaining paragraphs | Comments